A Biased View of Atlanta Hard Money Lenders

Wiki Article

Not known Facts About Atlanta Hard Money Lenders

Table of ContentsRumored Buzz on Atlanta Hard Money LendersThe Buzz on Atlanta Hard Money LendersAtlanta Hard Money Lenders Things To Know Before You BuyAtlanta Hard Money Lenders - The FactsThe 30-Second Trick For Atlanta Hard Money LendersThe 9-Minute Rule for Atlanta Hard Money Lenders

In most cases the approval for the tough money financing can happen in just eventually. The tough money lending institution is mosting likely to consider the residential or commercial property, the amount of down repayment or equity the customer will have in the building, the consumer's experience (if suitable), the leave approach for the property and also make sure the consumer has some cash reserves in order to make the regular monthly lending settlements.Investor that have not previously made use of difficult money will certainly be impressed at just how promptly difficult cash loans are funded contrasted to banks. Compare that with 30+ days it takes for a financial institution to fund. This speedy funding has conserved various actual estate investors who have been in escrow only to have their original lender take out or merely not supply.

Their checklist of needs enhances each year and also a number of them appear arbitrary. Banks likewise have a checklist of concerns that will certainly elevate a warning and also stop them from also thinking about providing to a borrower such as recent foreclosures, short sales, car loan adjustments, and personal bankruptcies. Poor credit is another factor that will avoid a financial institution from lending to a borrower.

Everything about Atlanta Hard Money Lenders

Fortunately for real estate financiers that might presently have some of these problems on their record, difficult cash lending institutions are still able to provide to them. The tough cash lenders can lend to customers with issues as long as the debtor has enough deposit or equity (a minimum of 25-30%) in the residential or commercial property.When it comes to a potential customer that wishes to acquire a key home with an owner-occupied tough cash lending with a personal home mortgage loan provider, the consumer can initially buy a residential or commercial property with hard cash and afterwards function to fix any issues or wait the necessary amount of time to clear the issues.

Financial institutions are also unwilling to offer mortgage to debtors that are self-employed or presently lack the required 2 years of work background at their current setting. The debtors might be an excellent prospect for the finance in every various other facet, however these approximate needs stop financial institutions from extending financing to the customers.

The Ultimate Guide To Atlanta Hard Money Lenders

When it comes to the debtor without adequate employment history, they would have the ability to refinance out of the difficult cash lending and into a lower expense conventional loan once they obtained the essential 2 years at their present position. Tough cash lending institutions supply numerous finances that traditional lending institutions such as banks have no interest in financing.

These tasks entail a genuine estate financier acquiring a residential property with a short-term lending so that the financier can rapidly make the required repair work as well as updates and also after that market the home. atlanta hard money lenders. The actual estate capitalist only needs a 12 month finance. Banks intend to lend money for the long term as well as are happy to make a little quantity of interest over a lengthy duration of time.

The concerns can be connected to structure, electrical or pipes as well as might trigger the bank to think about the home uninhabitable and also incapable to be moneyed. and also are unable to consider a lending circumstance that is beyond their rigorous borrowing criteria. A tough money lending institution would certainly be able to offer a customer with a financing to buy a building that has concerns preventing it from receiving a traditional small business loan.

The Buzz on Atlanta Hard Money Lenders

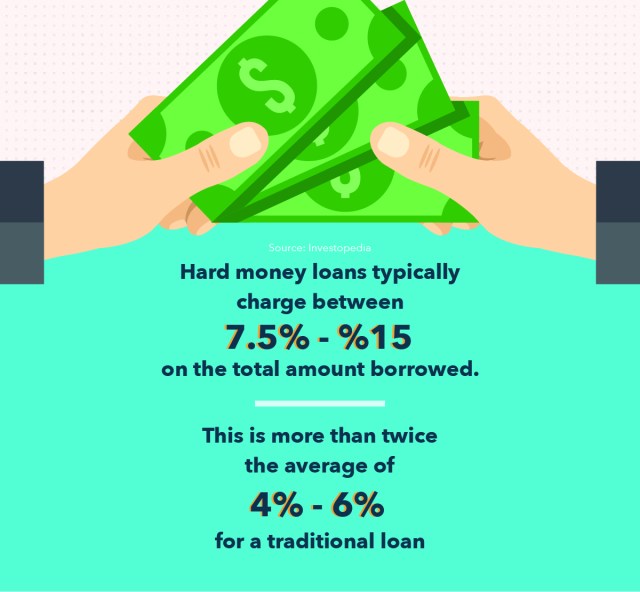

Hard cash check this lenders also charge a car loan source charge which are called factors, a percent of the financing quantity. atlanta hard money lenders. Points normally vary from 2-4 although there are lending institutions who will charge much higher factors for details situations. Particular areas of the country have several contending hard cash loan providers while other locations have couple of.

In huge cities there are typically a lot more hard cash lending institutions going to lend than in even more remote rural locations. Customers can benefit greatly from checking rates at a few various loan providers before dedicating to a hard cash lender. While not all difficult cash lending institutions use 2nd home loans or count on acts on homes, the ones who do charge a greater rate of interest on 2nds than on 1sts.

The 7-Minute Rule for Atlanta Hard Money Lenders

This increased rates of interest reflects the enhanced risk for the lending institution being in second placement rather than 1st. If the borrower enters into default, the 1st lien owner can foreclose on the building and eliminate the 2nd lien owner's rate of interest in the property. Longer regards to 3-5 years are readily available however that is generally the ceiling visit their website for loan term size.If rates of interest drop, the debtor has the choice of refinancing to the reduced existing rates. If the interest rates raise, the debtor is able to keep their lower passion rate financing and lender is compelled to wait until the funding becomes due. While the lender is awaiting the funding to become due, their financial investment in the trust action is generating less than what they can obtain for a brand-new depend on deed financial investment at present rates.

The 5-Minute Rule for Atlanta Hard Money Lenders

This is a worst instance circumstance for the difficult cash loan provider. In a similar situation where the customer places in a 30% deposit (instead of only 5%), a 10% decline in the worth of the property still provides the customer lots of motivation to stick with the residential property and job to shield their equity.Report this wiki page